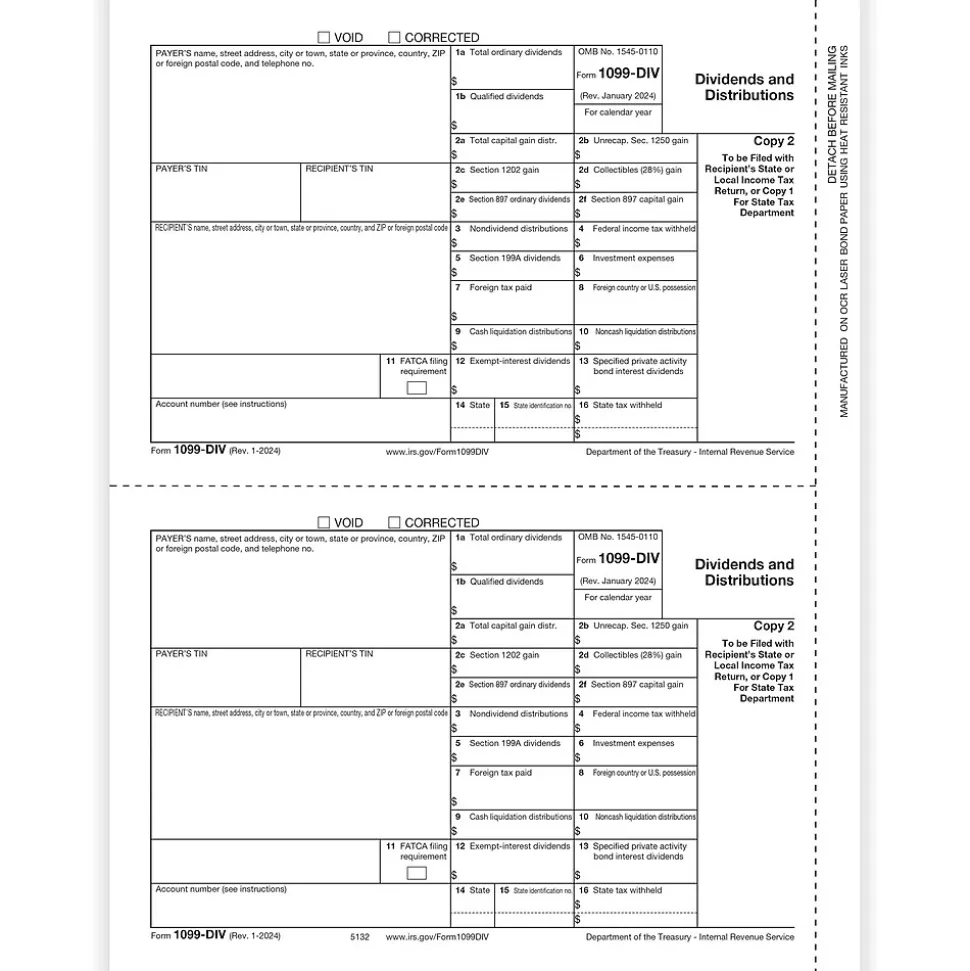

ComplyRight Tax Forms<2024 1099-DIV Tax Form, 1-Part, 2-Up, Payer Copy C, 50/Pack (513250)

$20.16

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interes…

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends), and other distributions.

- File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation.

- Payer Copy C and/or State, 2-Up

- 1 Page Equals 2 Forms

- Pack of 50 tax forms

| Attribute name | Attribute value |

|---|---|

| Length in Inches The different types of selling UOM: Pack, Case, Carton, etc | Pack |

| Number of Parts Actual manufacturer name for the color of the product. | White/Black |

| Acid Free The tax year the form is applicable to. | 2024 |

| Width in Inches | Laser |

| Tax Form Pack Size | 1099-DIV |

| Number of Recipient or Employees | 26-50 |

Be the first to review “ComplyRight Tax Forms<2024 1099-DIV Tax Form, 1-Part, 2-Up, Payer Copy C, 50/Pack (513250)” Cancel reply

Related products

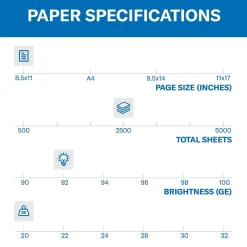

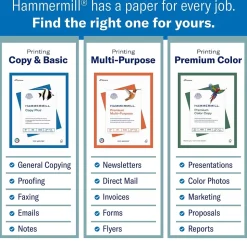

Copy & Printer Paper

$22.68

Copy & Printer Paper

$24.30

Copy & Printer Paper

$51.84

Copy & Printer Paper

$33.00

Copy & Printer Paper

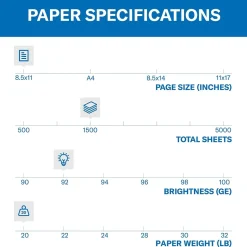

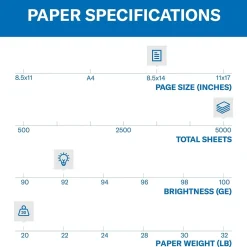

Staples Copy Paper<11" x 17" Copy Paper, 20 lbs., 92 Brightness, 500 Sheets/Ream (190450)

$12.80

Construction Paper

Tru-Ray Construction Paper<9" x 12" Construction Paper, Salmon, 50 Sheets (P103010)

$4.05

Copy & Printer Paper

$17.64

Copy & Printer Paper

$61.11

Reviews

There are no reviews yet.